Investors have increasingly turned attention to sustainability. They recognize importance of environmental social and governance (ESG) criteria.

These criteria significantly influence investment decisions. Consequently companies now strive to align with these values. Such alignment is essential. It can enhance attractiveness to potential investors.

Investment Trends:

The trend toward sustainable investing gains momentum:

More investors seek opportunities that offer both financial returns and positive societal impact This trend reflects broader shift in investment philosophy Investors are motivated by desire for ethical stewardship They want to contribute to healthier planet This creates demand for companies that focus on sustainable practices

Corporate Response:

Companies have begun to respond to demand. They are implementing strategies that emphasize sustainability. This includes reducing carbon footprints. Companies are also adopting fair labor practices Transparency in supply chains has become priority Firms now recognize that choices affect their reputation A strong commitment to sustainability can attract discerning investors.

Future Outlook

Looking Ahead Path for sustainable investing seems promising. More institutional investors likely prioritize ESG factors in portfolios. This shift indicates structural change in finance. Scholarships and research initiatives support evolution. Educational institutions emphasize sustainability in finance programs. Future leaders in finance become well-equipped. They will navigate this landscape with competence.

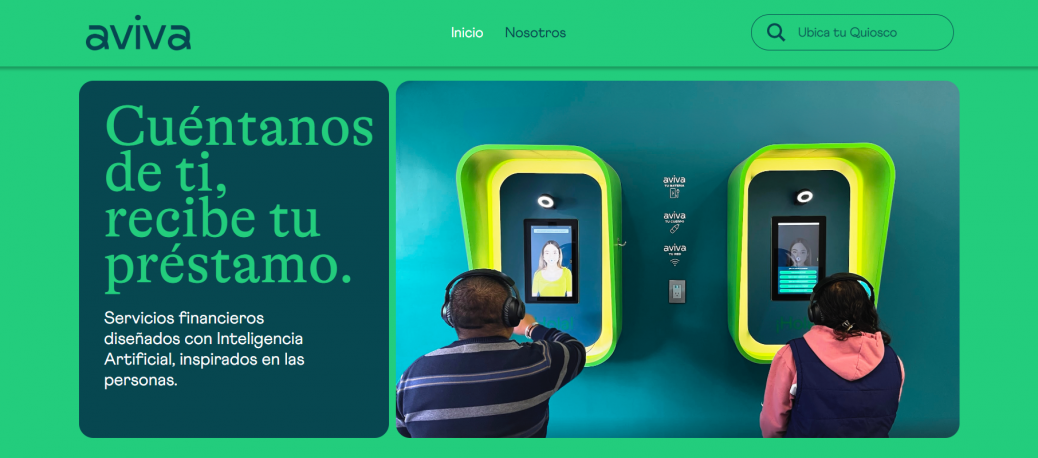

Aviva Financial:

Revolutionizing Access to Credit in Mexico Aviva Financial transforms financial landscape in Mexico. It addresses significant challenges people face when seeking credit. Traditional banking systems often overlook underserved populations. This exclusion has led to lack of access to essential financial services. Many individuals and small businesses struggle to secure funding. They may not meet stringent requirements set by banks. Aviva Financial employs innovative technology to provide tailored solutions.

Their platform utilizes advanced algorithms. These algorithms assess creditworthiness in unprecedented ways. They account for various factors beyond credit scores. By doing this Aviva opens doors for many who would otherwise remain unbanked. Company aims to empower individuals and entrepreneurs. Access to credit can create opportunities for personal and economic growth. By simplifying application process Aviva enhances user experience.

The platform is user-friendly and accessible. It allows clients to apply for loans quickly and conveniently Aviva also prioritizes financial education. Firm offers resources that help clients understand credit. This knowledge enables informed decision-making. By investing in education Aviva builds trust with its clientele. It fosters long-term relationships with customers. It promotes financial literacy. Impacts of Aviva’s model are significant.

More individuals are becoming economically active. Small businesses increasingly secure necessary funding. This change leads to growth of local economies. Aviva Financial paves way for more inclusive financial system. It challenges norms of traditional banking in Mexico

Introduction to Aviva Financial In era where financial inclusion is critical to economic progress Aviva Financial emerges as beacon of innovation and reliability. Based in Mexico, this fintech company reshapes landscape of consumer lending. They provide user-friendly rapid loan services.

Innovative Approach with Artificial Intelligence At heart of Aviva Financial’s operations is pioneering use of Artificial Intelligence (AI). This technology streamlines lending process. It enhances efficiency. It ensures accuracy and speed in evaluating loan applications. By integrating AI Aviva offers personalized financial solutions. These solutions arise from real people and real needs

Reliable Financial Solutions Aviva Financial:

A Testament to Reliability Aviva Financial prides itself on reliability. Customers like Luis from Ixtapaluca attest to quick experience of obtaining loan. His experience reflects efficiency and responsiveness. Ana from Tlaxcala echoes this sentiment. Her account underscores hassle-free process Aviva provides. Such ease enhances overall customer satisfaction. These testimonials highlight Aviva’s commitment to excellence. Furthermore they demonstrate dedication to assisting customers on their journey toward financial success.

Easy Application Process One key feature of Aviva’s service is ease of application. Potential borrowers can complete applications through video call. They can do this at any of kiosks. This process eliminates paperwork. It also eliminates need for physical bank visits. Thus it is convenient for users across Mexico

Economic and Fair Pricing Aviva stands out for fair pricing model. Company offers loans without hidden fees There are no upfront payments required This ensures transparency and fairness This approach is particularly appealing in market characterized by consumer distrust towards financial institutions Such distrust often arises due to unexpected costs

Fast Service Speed is another cornerstone of Aviva’s service. Approval occurs in real time. This happens at end of video call. Customers can receive money within 24 hours. This rapid service proves crucial for individuals. They often require urgent financial assistance.

Three-Step Loan Process

1. Video Call at Kiosk: Applicants initiate process by visiting kiosk. They must present INE or National Electoral Institute card along with phone number.

2. Real-Time Approval: After video call concludes approval is provided immediately.

3. Receiving Funds: Once loan is confirmed, funds are transferred to customer’s account. This often occurs in under 24 hours.

Impact on the Mexican Economy Aviva’s services extend beyond individual loans. They focus on enlivening entire Mexican economy. Through accessible financial services Aviva empowers individuals. This empowerment allows individuals to enhance their living standards. It also contributes to broader economic development of country.

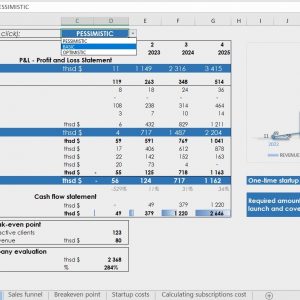

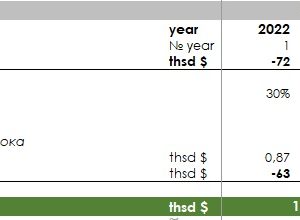

Significant Investment in August 2024 In August 2024 Aviva Financial secured substantial investment. Amount raised was $5.5 million. This investment came from consortium of investors. Notable participants included 500 Global Digital Currency Group Carao Ventures Credicorp Krealo Newtopia VC Wollef Ventures IGNIA Rainforest Capital Partners and Magna VC. This early venture capital round underscores trust that financial market has in Aviva’s innovative approach. It highlights confidence in potential for growth.

Kiosks Across Mexico Aviva’s Kiosks in Mexico Aviva has established 24 kiosks across Mexico. This expansion makes services accessible to wider audience. Locations include Tecamachalco Ozumba, Actopan and Chiautempan. Each kiosk is equipped to provide efficient service. Additionally friendly service remains priority.

Investor Confidence and Company Backing The growth and innovation at Aviva are made possible by robust investor support. Company backers are integral to its success. They provide capital needed to develop new solutions. They also assist in expanding services. Aviva operates under legal supervision by Mexico’s National Banking and Securities Commission. This oversight ensures compliance with financial regulations.

A Bright Future for Aviva With advanced technology customer-focused services and transparent pricing model, Aviva Financial is poised to continue innovating in financial sector. More individuals are seeking lending solutions from Aviva. Thus future appears promising. This outlook benefits not only company but also many Mexicans who rely on Aviva for attaining financial stability. Many individuals recognize potential for growth. They seek security through this partnership. Success in these endeavors is not limited to institution alone. It extends to customers who trust Aviva.

Economic Vitality

Aviva Financial is not simply lending institution. It is vital part of Mexico’s financial ecosystem. It contributes significantly to economic vitality of country. Moreover it offers lifeline to individuals in need of quick financial assistance. As it continues to grow Aviva refines its array of services. The company undoubtedly sets new standard for fintech in Latin America. — This revised article now includes significant investment event. It highlights trust in Aviva Financial. Additionally it emphasizes potential growth of company. Implications of this investment are profound. Stakeholders visibly exhibit confidence in future prospects. Analysts suggest that trust may catalyze further investments. Market response reflects optimism regarding continued expansion. Firm’s strategies indicate readiness to seize emerging opportunities. In conclusion, revised article provides insight into transformative moment for Aviva Financial

August 6, 2024